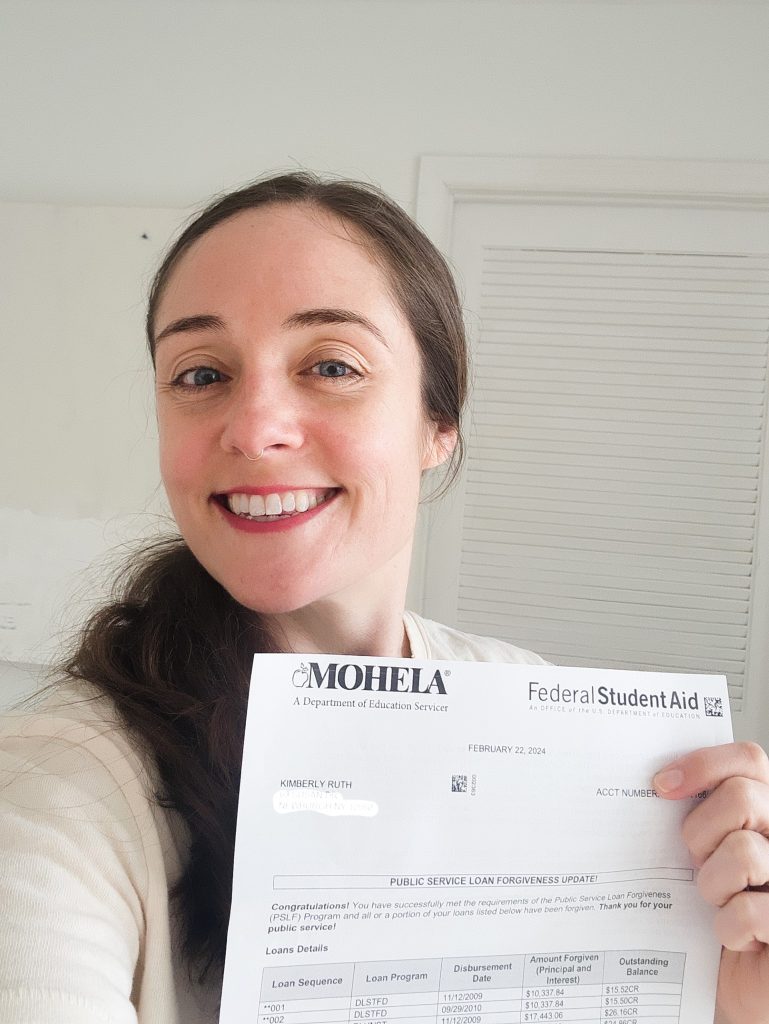

An interview with Kimberly Ruth, Adjunct Lecturer in Digital Media and Journalism

UUP: What was your loan situation after completing your degree? How much did you owe?

KR: Tuition for my graduate degree was $44,000. I was accepted into my chosen program directly from undergrad so I did not have money saved to help with the cost of tuition. In order to enroll, I had to take out a loan for the full $44,000. However, by the time my loans were forgiven 12 years later, my balance increased to $58,000. This is because the monthly payments I could afford did not touch my loan’s principal.

UUP: Did you have difficulty paying back the loans? What was your employment status?

KR: Impossible is a more accurate word to use. Since graduating Tufts University in 2012 I have been working as an adjunct professor, oftentimes teaching at multiple universities in a single semester. With an adjunct salary of approximately $16,000-$22,000 per year, making student loan payments above $350/month was not possible. Even though I was on an income-based repayment plan (which meant I was only required to pay $10/month due to my low salary), $350 was required to cover the interest. In short, I was paying anywhere from $150 to $500 per month (depending on the month) to see my debt grow because I was unable to cover the interest of the loan.

UUP: Did this situation cause you hardship?

KR: Significant hardships. Many major life decisions, such as choosing not to have children, were in large part due to my growing debt. In addition, the daily mental stress of weighing the pros of working my dream job vs the reality that my current rank does not allow me to pay off my debt, was debilitating.

UUP: How did you find out about the loan forgiveness program?

KR: I first learned about the Public Service Student Loan Forgiveness program (PSLF) through my loan servicer. I applied for forgiveness through this program 8 years ago but I was quickly rejected because of my part-time status as an adjunct professor; in order to qualify for PSLF, one has to work in a full time capacity.

Then in September of 2022, UUP sent out an email announcing adjunct faculty could now potentially receive student loan forgiveness under PSLF due in part to a new bill that was signed by Gov. Hochul.

UUP: How did you initiate the process?

KR: First, I became familiar with Hochul’s bill. In short, the bill redefines what it means to be a full-time employee in higher education for the purpose of determining eligibility for loan forgiveness.

Previously, adjuncts were not considered full-time employees by Federal Student Aid (the entity that actually forgives the loans). This is because adjuncts are only paid for the work they do INSIDE the classroom. But as all of us in academia know, it is impossible to conduct a class without doing any work outside the classroom. If we did, students wouldn’t receive grades, syllabi, assignments, letters of recommendations, etc. Even though adjuncts still don’t get paid for this out-of-classroom work, the new bill states that this work should be counted as working hours for the purposes of loan forgiveness.

Having worked as an adjunct for 12 years, I must admit, this change in work acknowledgment seemed too good to be true. So I went to Federal Student Aid’s website to see if they posted a change in qualifications for forgiveness. And sure enough, right on the PSLF homepage was THE sentence that led to my forgiveness.

“Full-time employees are determined by multiplying each credit or contact hour taught per week by at least 3.35 in non-tenure track employment at an institution of higher education.”

I quickly printed out the webpage and gathered up all the material I thought Human Resources would need to sign off on my application: my PSLF application, Hochul’s bill and a screenshot of Federal Student Aid’s homepage.

It took weeks of diligent research by HR but eventually they signed my application and confirmed that I was a full-time employee for the sake of student loan forgiveness due to my work inside AND outside the classroom.

UUP: Was it difficult? Were there requirements that were hard to fulfill or ambiguous given your work history?

KR: Understandably, many people in HR were nervous to put their names on a document stating that an adjunct is a full-time employee, so navigating that barrier was tough. Though HR did not ask me for additional proof of work, I took it upon myself to print out a log of the work that I do outside of class time as a way to justify a full-time classification. I laid out the amount of hours it takes to grade, create assignments, update Brightspace, respond to student emails, etc, etc, etc. I am not sure if that unofficial log is what led to them signing my application, but I am sure it didn’t hurt. I would encourage any adjunct who is applying for forgiveness to do the same.

UUP: What would you recommend to other adjuncts who are struggling with student loan debt?

KR: Apply for forgiveness! And start the process now. Even if it is your first year working in the public sector and even if you are not sure you will qualify, apply. Get yourself in the system. Go to studentaid.gov and fill out the PSLF application. Then go to HR and tell them you want to start the process of certifying employment for loan forgiveness.

UUP: What was the outcome of your effort to take advantage of this program?

KR: My student loan debt of $58,000 was canceled and my balance is now $0.

UUP: How has your life changed as a result?

KR: Financially, it is too early to tell (I just received my letter of forgiveness this month). But in terms of my overall well-being, I am significantly happier, more confident and I think a better teacher because of it.

The process of advocating for myself and my work helped me to re-envision my sense of worth and value in the workplace. At first it felt strange to itemize the work I do for my classes, but as the prospect of obtaining loan forgiveness became closer, an unexpected thing happened. Instead of being embarrassed about my work–considering the work-to-adjunct pay-ratio–I became proud. I became convinced that I DESERVED this forgiveness. And during this realization, my goal to receive loan forgiveness became much larger than just my loan. I want this win so that ALL adjuncts can receive forgiveness.

While obtaining forgiveness for myself is hugely life-changing, I will not consider it a win until other adjuncts also receive the relief they deserve. Hopefully, we will get to a point where we don’t have to justify our work for loan forgiveness. Or better yet, justify our work for a liveable wage. When and if that day comes, then it will be a win truly worth celebrating.